Home Repair Deductions 2020

The 30 tax credit applies to both labor and installation costs. Married couples filing separately will see the phase-out start at 50000.

Tax Deductible Home Improvements Repairs For 2021 Walletgenius

You cant deduct any of the taxes paid in 2020 because they relate to the 2019 property tax year and you didnt own the home until 2020.

Home repair deductions 2020. 17092020 Repairs can be deducted immediately if the total amount paid for repairs and maintenance on the property is 10000 or under or 2 of the unadjusted basis of the property whichever amount is less. 08032021 Claiming the deductions youre eligible for is only worth the effort if all of your itemized deductions exceed the IRS standard deduction. After 2018 PMI premiums arent tax deductible any longer.

Business Use of Your Home. However there are some ways that home repairs can lower your tax bill. 22 for property placed in service after December 31 2020 and before January 1 2022.

When people think of home repairs they dont generally think of doing them as being a way to lower their tax liability. Minor repairs are attempted to ensure the property remains habitable for occupants. While I dont think a 1500 tax deduction will change your life it will save.

26 for property placed in service after December 31 2019 and before January 1 2021. For a 2000 square foot office thats a 1000 deduction. 17032020 It allows homeowners to deduct 5 per square foot of home office space but the entire deduction is limited to 1500.

There are no maximum limits on the amount refunded other than for fuel cells. 27012021 Wear and Tear Renewals Allowance Minor repairs and maintenance are tax deductible although major renovations such as entire room refurbishments are not. After 110000 theres no deduction.

15072019 As it stands you can deduct 100 of the money you spend on making repairs to your home office though again to do so you must meet the standard qualifications for the home office deduction. Under existing IRS guidelines the initial 250000 of benefit on the selling cost of your principal dwelling is tax-exempt 500000 for wedded couples who submit joint expense forms when you have possessed and lived in your home for a minimum of 2 of the 5 years leading up to the deal. 28032019 Running a home-based business can offer tax deductions on home repairs in addition to typical business expenses.

2 - Home Repairs and Improvements. This safe harbor is only available for businesses with revenues under 10 million and when the property being repaired has an unadjusted basis under 1 million. This tax deduction cannot be used when you spend the money but they can be used to reduce your taxes in the year you decide to sell your house.

31122020 Whenever you make a home improvement such as replacing the windows or installing a brand-new HVAC system you may be able to use those investments to claim a home improvement tax deduction. For example if you spend 20000 on installing new solar panels you would get a credit for 6000. That number is 12400 for 2020 for individuals and twice that for married couples.

They might help you to claim a home improvement tax deduction when you sell your home. 26 for property placed in service after December 31 2019 but before January 1 2021. When you sell a home you will likely have to make some home repairs or improvements to get it buyer ready.

If you rent out a portion of your home then you are able to take advantage of all of the tax deductions available to landlords and this includes home repair deductions. 30 for property placed in service after December 31 2016 but before January 1 2020. 19082020 August 19 2020 Tax Deductions.

The home rental deduction. Note that this deduction is limited to 300 square feet. The key determiner is whether the proposed alterations will provide additional value.

It begins to be phased out after 100000. 31012020 Once You Sell. In addition you must have lived in the home for at least two out of the past five years.

01042019 To qualify for this deduction your home must be your principal residence not an investment property. Once you make a home improvement like putting in central air conditioning installing a sun-room or upgrading the roof you are not able to deduct the expense during the year you spent the funds. If theres an extension the amount you can deduct depends on your household income.

You should maintain a record of those costs. 22 for property placed in service after December 31 2020 but before January. For more details on home office write-offs consult IRS Publication 587.

19022021 If you renovated a few rooms to make your home more marketable and so you could fetch a higher sales price you can deduct those upgrade. There are tax deductions and credits available that are applicable when you first purchase the home and even afterward. 31032021 You can claim three applicable percentages for the Residential Renewable Energy Tax Credit.

19062020 30 for property placed in service after December 31 2016 and before January 1 2020. Fuel cells are the exception to this. Getty Images The global coronavirus pandemic has had a major impact on businesses across the country by forcing many people to work from home until the situation improves.

So what other home remodeling is tax-deductible in 2020. 31122020 For the 2020 tax year just multiply 5 by the area of your home.

Are Home Improvements Tax Deductible It Depends On Their Purpose

What Types Of Home Improvements Are Tax Deductible

Quiz Do I Qualify For The Home Office Deduction

Are Home Repairs Tax Deductible Double J Siding Windows

How To Deduct Your Home Office On Your Taxes Forbes Advisor

5 Tax Deductions When Selling A Home Did You Take Them All

Work From Home Tax Deduction Only Applies To Self Employed Workers

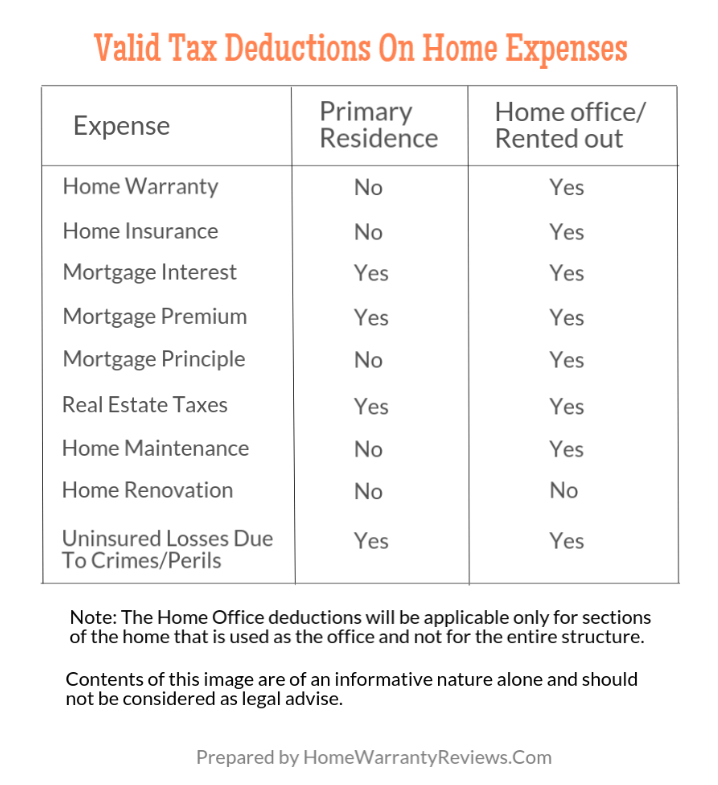

Are Home Warranty Premiums Tax Deductible

The Thrill Of Diving Into Home Repair Projects

Post a Comment for "Home Repair Deductions 2020"